In Africa’s rapidly evolving marketplace, legacy brands once stood as cultural icons, commanding deep trust,…

How PiggyVest Built Deep Customer Relationships to Grow Its Brand in Africa

When PiggyVest launched in 2016, it wasn’t the only fintech product in the Nigerian fintech space. However, in a few short years, the digital savings and investment platform rose to become one of the most trusted financial brands in Africa. How did it happen? The answer lies in one powerful strategy: building deep, meaningful customer relationships.

This article explores how PiggyVest did just that and how its customer-centric approach became the bedrock of its brand identity across Africa.

1. Solving a Real Problem with Empathy

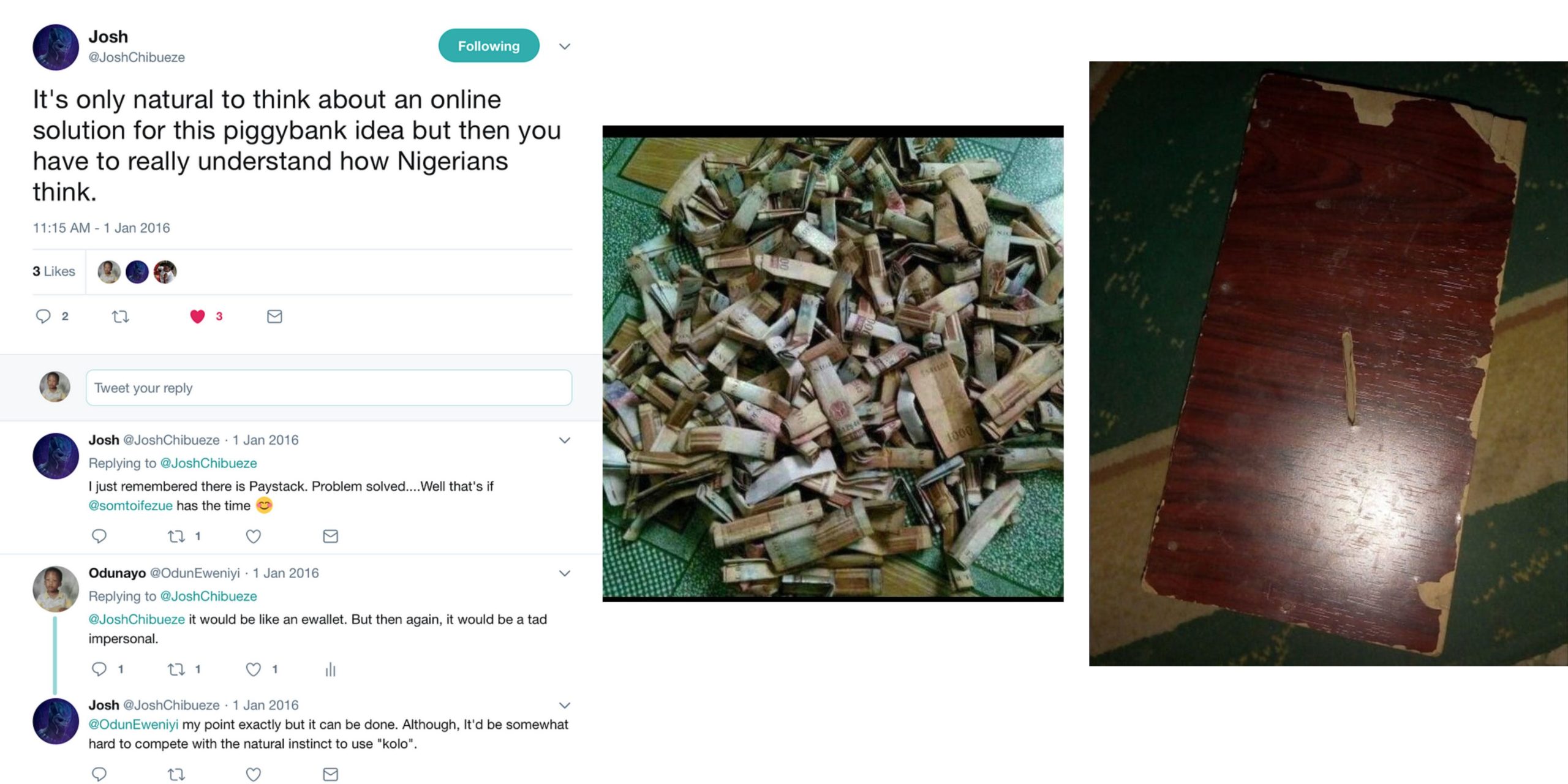

PiggyVest was inspired by a 2015 viral tweet by user Oluwafisayomi, who shared how she locked money in a wooden box to avoid spending it. Instead of dismissing the tweet, co-founders Somto Ifezue, Odunayo Eweniyi, and Joshua Chibueze saw a real need: young Nigerians wanted to save, but lacked discipline and tools. They built Piggybank.ng to mimic the wooden box but digitally. That foundational empathy shaped everything that followed.

2. Prioritizing Financial Literacy For Customers

PiggyVest didn’t just build tools for saving and investing money, it taught users how to use money better. The brand used an educational approach to built trust and positioned PiggyVest as a financial ally which kept users engaged long-term. Some Examples of how they achieved this includes:

- The PiggyVest Blog where they share weekly tips on budgeting, savings, and investment.

- Their “Money Personality Quiz” helped users understand their financial behavior in a fun, interactive way.

- In 2022, they launched a “#SavingsChallenge” series on Instagram to guide users toward consistent habits.

- Their annual “Money Matters with PiggyVest” report reveals insights into how Nigerians save and spend money. A content marketing masterclass that boosts both education and brand credibility.

3. Building a Strong, Relatable Voice

PiggyVest’s X account (@Piggyvest) is known for being humorous, contextual, and deeply local. The brand understands that their customers are humans with certain traits and reside in certain location, so they ensure that their content is localized and they speak to these customers in the language that they understand. For example, they use popular Nigerian slang like “sapa” (being broke) to talk about saving.

This “relatable content” strategy creates a sense of community and belonging, which turns customers into brand advocates. Their social media accounts feel less like corporate handles and more like a smart friend giving you real money advice.

4. Customer Feedback as a Growth Engine

Many PiggyVest features came from direct user requests. The team regularly ran surveys, monitored user comments, and even responded in real time to issues or suggestions. This open communication helped shape product features like Flex Dollar, target savings groups, and more. By involving users in product evolution, PiggyVest created a sense of co-ownership. People felt like the app was theirs and that’s powerful branding.

5. Transparency and Trust-Building

In Nigeria’s fintech space, trust is currency. PiggyVest earned it by being open and proactive. The brand shared clear terms of service, regular financial updates and security assurance messaging to keep users informed and reassured.

Examples:

- After changing its name from Piggybank to PiggyVest in 2019, it communicated the rebrand clearly, emphasizing growth and future offerings.

- Following the failed investment platform MBA Forex scandal (which affected Nigerian trust in fintechs), PiggyVest publicly clarified their investment process and partners to reassure users.

- Partnered with AIICO Capital, a registered fund manager, to guarantee investments, a move they clearly explained on their platform.

6. Showcasing Real Success Stories

PiggyVest constantly shares testimonials from real users who achieved savings goals. Rather than rely on influencer hype or flashy ads alone, PiggyVest invested in user-generated content and real-life testimonials. These stories weren’t just inspirational, they also stood as proof of value which made prospective users believe they could achieve similar results.

Examples:

- In their 2023 “Money Matters” report, they spotlighted a user who saved ₦500,000 in 8 months to fund a master’s degree.

- They launched the #MyPiggyStory hashtag on social media to let users share how the platform helped them save for cars, rent, laptops, and even weddings.

- On Instagram and LinkedIn, they’ve featured creators, entrepreneurs, and students who used PiggyVest to achieve major financial milestones.

7. Community Building Through Challenges & Events

Piggyves came up with challenges to give their users a shared mission. They utilized both offline and online events which helped humanize the brand even further. We can say PiggyVest created a tribe of loyal users, not just app downloads. Some of these coommunity engagements include:

- Their “Savings Streak Challenge” encourages users to save daily or weekly and win rewards if they maintain consistency.

- Annual Year-End Savings Challenge: In December, they push users to complete their goals with leaderboards and gamification.

- The 2021 PiggyVest End-of-Year Party (PiggyVersary) was an invite-only event for top savers, a community reward and loyalty play.

- Their “Refer & Earn” program incentivizes users to bring others in, expanding the brand organically.

PiggyVest’s journey offers a lesson to any African startup looking to build a beloved brand: Start with the people. Don’t just market a product—solve a real problem, speak the user’s language, involve them in your journey, and keep the relationship alive long after signup. That’s how PiggyVest turned users into loyal fans, and a fintech app into one of Africa’s most recognized digital brands.

Related Content